- Fresh Trade Ideas

- Posts

- Sunday Setups - 3/3

Sunday Setups - 3/3

In like a lion, out like a lamb?

Happy Sunday,

To make your Monday more enjoyable, we’ve prepared some Fresh Trade Ideas for you. They go nicely with a freshly squeezed glass of lemonade!

What is the Sunday Lemonade?

It’s a short review of trades from last week and a detailed overview of trade ideas for this week. Build your trading strategy for the week in the time it takes to finish a glass of lemonade.

Before we get started, a friendly reminder that if you join Fresh Trade Ideas Community, you’ll unlock instant access to:

📈 All of our Premium Trade Ideas.

⏰ Real-time trade alerts throughout the week.

📗 Learn how to find the best setups on your own.

❓Ask any questions about setups, the market, or options.

And much more.

Alright, is that sugar kicking in? Let’s find some edge!

Quick Summary

Market Review

Before we dive in to the individual trades that I am looking to take, I want to do a quick review of where the markets stand. Understanding the overall market trend will help guide us with how we approach these trades.

/ES (S&P Futures) & /NQ (Nasdaq Futures)

This past week was a chop fest that ended with a bang! It seemed like everyone was waiting for the PCE Price Index, which is the Fed’s primary inflation measure. This came out on Thursday morning. If you haven’t noticed, there is a lot of attention focused on whether or not the Fed will lower rates at all this year!

The index came in as expected, and stocks rallied. The light volatility in the first half of the week offered some opportunity for good entires, and the relentless bull move Thursday afternoon into Friday allowed us to take some solid profits.

The indices are strong, and while we should approach the market with caution at these levels, the bearish argument is harder and harder to make - at least until the /NQ daily squeeze fires.

/NQ Daily chart

/NQ Weekly chart

I’m looking for the daily squeeze to fire long and take us to the extensions on the chart: 18,476 and potentially even 19,000. While 19K may seem far off, we have seen 700 pt moves happen in 1-2 weeks in recent past. I think the squeeze can sustain momentum higher.

Then, we will need to seriously consider lightening up and looking at short positions, as the put/call ratio continues to remain near 0.7 and has not risen.

In terms of this week’s events, we have some employment numbers and Powell talk on both Wednesday & Thursday. So, there could be some volatility around these events, as the market looks for any indication on what the Fed will do to rates this year.

No major earnings this week.

So, I will continue to focus on good setups to the long side.

Alright, let’s get back to the main show. Here is what I’m trading this week.

This week’s Trade Ideas

1.) BECN Long

Daily Chart Setup

Weekly Chart

Reasoning:

Bullish Trend (8 ema > 21 ema > 34 ema); trading with the trend

Daily Squeeze, which means a higher probability of making a larger move.

Near all-time highs, so less overhead resistance

My Levels:

Entry Zone: $85.5 - $86.3

8 ema down to the 34 ema (green line in chart)

The current price is in the entry zone. Entries are priced at current levels.

Targets: $91 - $100

T1: $91

T2: $93

T2: $100

All of these are based on fibonacci clusters from prior swings

BECN Options Strategies

**reminder: exits are theoretically priced two weeks out, but the price of the underlying is the primary trigger for taking the trade off.

Long Calls (Delta 74, 47 Days to Expiration, $80 Strike)

Entry: BUY +1 BECN 100 19 APR 24 80 CALL @8.20 LMT

Exit T1: SELL -1 BECN 100 19 APR 24 80 CALL @11.85 LMT

Exit T2: SELL -1 BECN 100 19 APR 24 80 CALL @13.50 LMT

Exit T3: SELL -1 BECN 100 19 APR 24 80 CALL @20.00 LMT

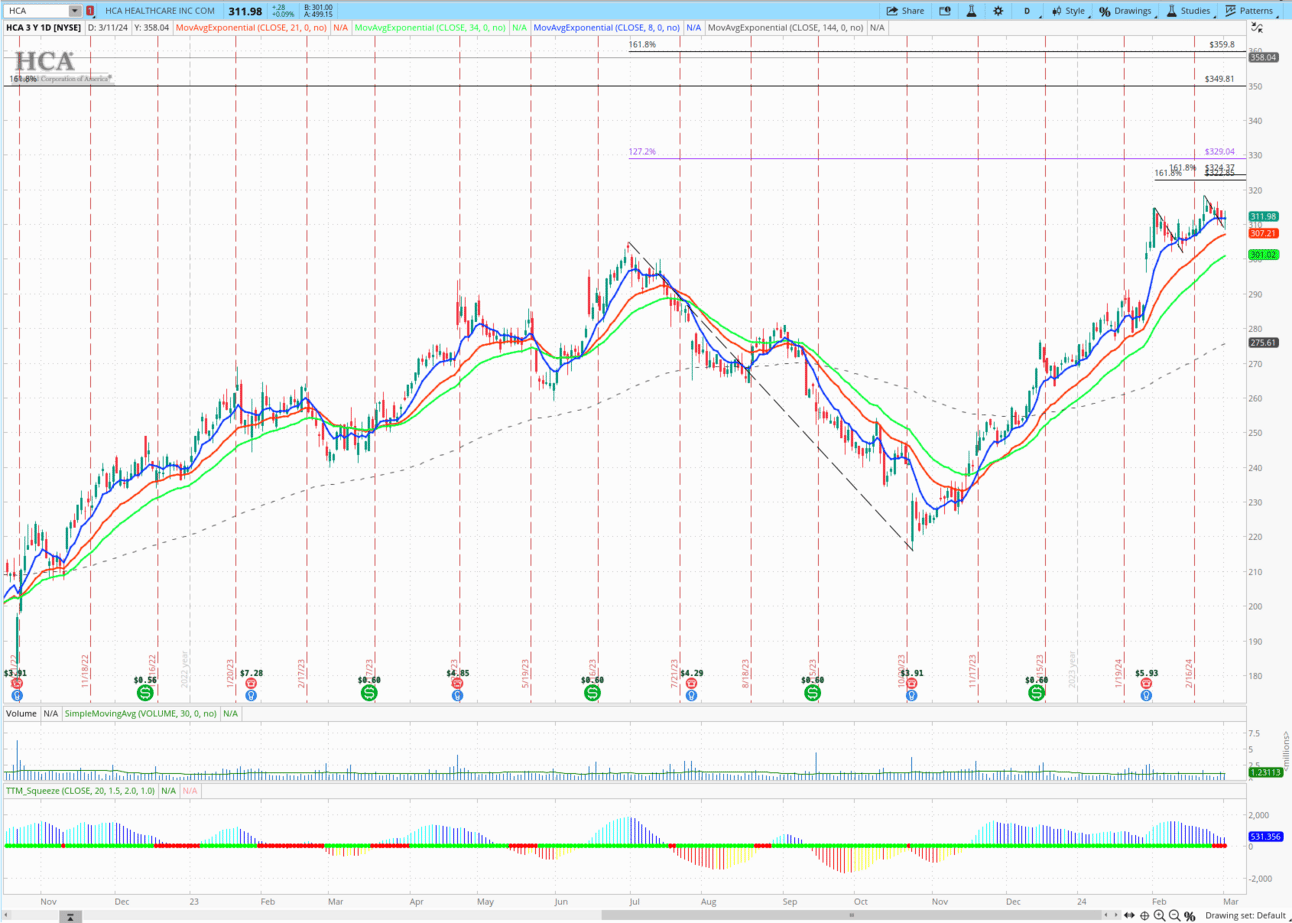

2.) HCA Long

Daily Chart Setup

Weekly Chart

Reasoning:

Daily Squeeze with positive momentum, which means a higher probability of making a larger move.

Near all-time highs, so less overhead resistance.

My Levels:

Entry Zone: $301 - $312

8 ema (blue line in chart) down to the 34 ema (green line in chart)

The current price is right at the entry zone. Entries are priced at current levels

Targets: $324 - $448

T1: $324

T2: $329

T3: $350

All of these are based on fibonacci clusters from prior swings

HCA Options Strategies

**reminder: exits are theoretically priced two weeks out, but the price of the underlying is the primary trigger for taking the trade off.

Long Calls (Delta 65, 47 Days to Expiration, $305 Strike)

Entry: BUY +1 HCA 100 19 APR 24 305 CALL @15.40 LMT

Exit T1: SELL -1 HCA 100 19 APR 24 305 CALL @22.50 LMT

Exit T2: SELL -1 HCA 100 19 APR 24 305 CALL @26.90 LMT

Exit T3: SELL -1 HCA 100 19 APR 24 305 CALL @46.50 LMT

Long Call Debit Spread (Buying $420 & Selling $450 strikes, 54 Days to Expiration)

Entry: BUY +1 VERTICAL HCA 100 19 APR 24 320/350 CALL @6.50 LMT

Exit T1: SELL -1 VERTICAL HCA 100 19 APR 24 320/350 CALL @10.50 LMT

Exit T2: SELL -1 VERTICAL HCA 100 19 APR 24 320/350 CALL @12.75 LMT

Exit T3: SELL -1 VERTICAL HCA 100 19 APR 24 320/350 CALL @21.75 LMT

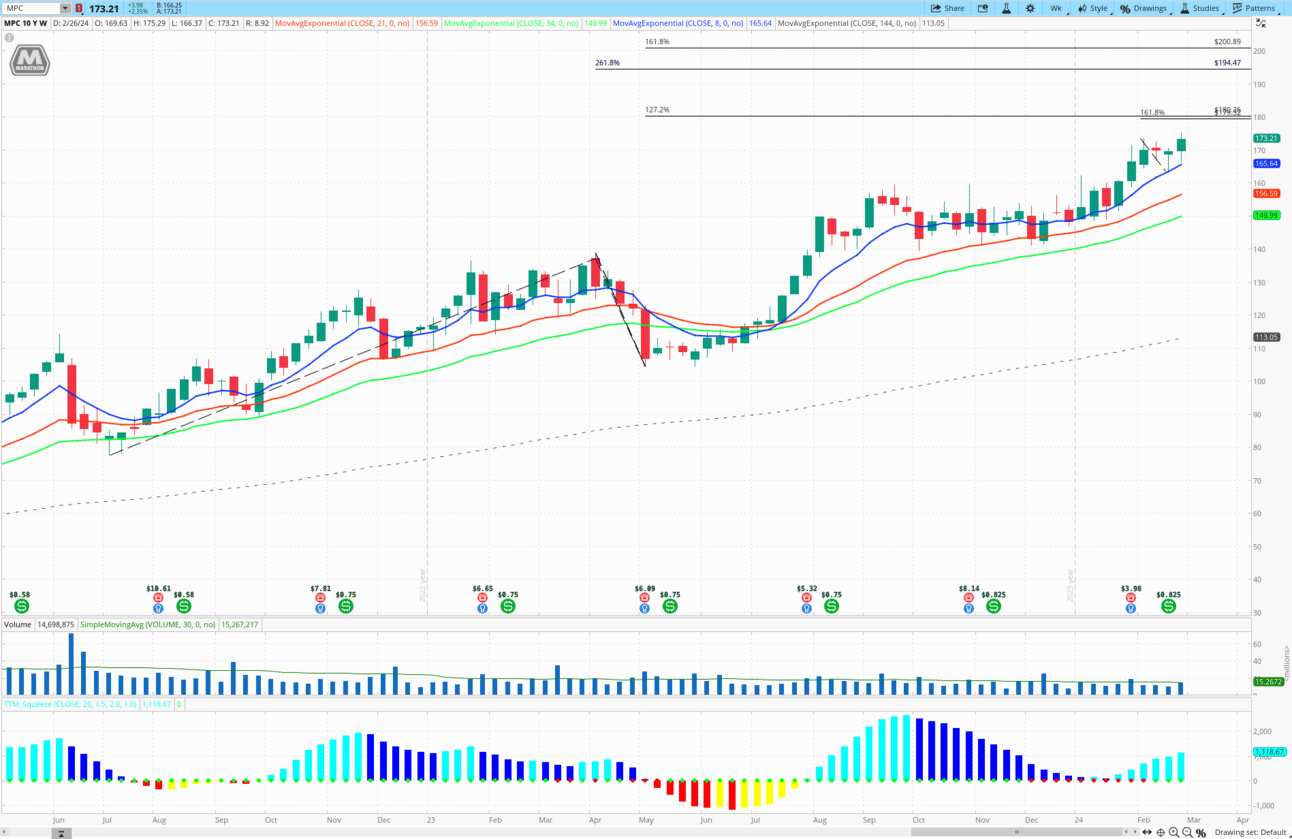

3.) MPC Long (again)

Daily Chart Setup

Weekly Chart

Reasoning:

Daily Squeeze with positive momentum, which means a higher probability of making a larger move.

Weekly squeeze has fired and has positive momentum

At all-time highs, so less overhead resistance.

My Levels:

Entry Zone: $168 - $173

Current price down to the 34 ema (green line in chart)

The current price is above at the ideal entry zone (in between the 8 ema and the 34 ema), but this has been strong and the weekly squeeze can lead to big moves. Entries are priced at current levels.

Targets: $180 - $195

T1: $180

T2: $195

All of these are based on fibonacci clusters from prior swings

MPC Options Strategies

**reminder: exits are theoretically priced two weeks out, but the price of the underlying is the primary trigger for taking the trade off.

Long Calls (Delta 62, 47 Days to Expiration, $170 Strike)

Entry: BUY +1 MPC 100 19 APR 24 170 CALL @9.40 LMT

Exit T1: SELL -1 MPC 100 19 APR 24 170 CALL @13.25 LMT

Exit T2: SELL -1 MPC 100 19 APR 24 170 CALL @26.25 LMT

4.) Others I’m Watching Long

INTU

INTU Daily Chart

ABNB

I’ll keep you posted on any trades I take!

Open Trades Review

Week of 1/28 Trade Ideas

UHS (CLOSED)

Took the other 2/3rds off just shy of $165, as I was not going to hold through earnings. This will probably take off, now that the uncertainty of earnings is over with, but nobody every went broke booking profits. Solid trade!

PVH (1/31 entry)

Still holding 2/3rd for $147 overhead. Chart still looks good, and made good progress this week. Running out of time, so I will book profits Monday or Tuesday, if we do not start to move.

Week of 2/4 Trade Ideas

GS (2/5 entry)

Good entry, but no targets hit yet. Still holding - chart looks good, and nothing has changed. Longest consolidation ever! We still have time on this with the April series.

CARR (2/5 entry)

Finally started moving - looking for follow through this week. Still holding.

Week of 2/11 Trade Ideas

LEN (2/13 entry)

Solid move into the end of the week. Took off half at T1: $160. Holding half for some follow through to $163. Holding into this week.

ACM (2/13 entry)

Still looks good. Holding.

IT (2/12 entry)

Starting to move, but I am running out of time. Will look to exit this week on a green day.

Week of 2/18 Trade Ideas

AMD (CLOSED)

Exited full position at $200 - nearly a triple on both the calls and spreads. Great trade, with little stress!

ISRG (2/20 entry)

Looks great and had a solid close Friday- holding for follow through this week. Holding full position.

JEF (2/21 entry)

Looks great and making progress upwards - low stress trade. Still hold full position.

Week of 2/25 Trade Ideas

ORLY (2/27 entry)

Solid progress - looks great. Holding full position.

ROP (2/26 entry)

A bit whippy, but solid close Friday - setup still in tact. Holding full position.

MSFT (2/27 entry)

Looks great - just waiting for daily squeeze to fire. Holding full position.

That’s it, that’s all. Let me know what you thought of this week’s Sunday Setups!