- Fresh Trade Ideas

- Posts

- Sunday Setups - 2/4

Sunday Setups - 2/4

Time to go short?

Happy Sunday,

To make your Monday more enjoyable, we’ve prepared some Fresh Trade Ideas for you. They go nicely with a fresh cuppa coffee!

What is the Sunday Setup?

It’s a review of trades from last week and a detailed overview of trade ideas for this week. Build your trading strategy for the week in the time it takes to finish a cup of coffee.

Before we get started, a friendly reminder that if you join Fresh Trade Ideas Community, you’ll unlock instant access to:

📈 All of our Premium Trade Ideas.

⏰ Real-time trade alerts throughout the week

📗 Library of educational content, designed to elevate your trading.

🧐 Learn how to find the best setups on your own.

❓Ask questions about trade setups, market trends, or anything trading related.

And much more.

Alright, is that caffeine kicking in? Let’s find some edge!

Quick Summary

This week’s Trade Ideas

Market Review

Before we dive in to the individual trades that I am looking to take, I want to do a quick review of where the markets stand. Understanding the overall market trend will help guide us with how we approach these trades.

/ES (S&P Futures) & /NQ (Nasdaq Futures)

What a week! Jerome Powell, and the beloved Fed gave a good jolt to the market, mentioning that they were not quite ready to lower rates. The probability for a rate cut in March went from 46% down to 38%, which contributed to the sell off.

This is based on how the fed funds futures trade, which can offer insight into the probability assigned to rate changes.

Lower rates benefit equities - particularly tech, as this affords them cheap cash to invest in longer-term growth, R&D, and finance acquisitions. So, hinting at a rate cut would be a bullish signal to the markets. If we look out to May, the probability of a cut has increased from 50% to 59% this past week, and up from 34% over the past month.

So, no rate cut in the near-term, but the market is looking for a potential rate cut in May. If the fed deviates from this, it could be bearish. So, keep that in mind whenever there is “fed-speak” over the next few weeks.

How does this impact our current view of the markets? Well, in the near-term, it doesn’t influence much, as price action has made it pretty clear the bulls are still in charge.

The sell-off into and after the Fed meeting provided many opportunities for entries, as price dipped nearly to the 21ema on both the /ES & /NQ. Then Zuck did what Zuck does best - he tried something new (dividend) and crushed it…and announced a buyback, META blew through the expected move on Friday, closing up 20% on the day. This ignited a further rally in /ES and /NQ that completely erased the decline we saw on Tuesday and Wednesday.

Once again patience pays - we started the week with a big green candle. It was tempting to be aggressive and chase, but Tues & Wed offered a healthy pullback. This allowed for better risk-adjusted entries closer to the mean (21ema). And that paid off fast, with a reversal Thursday and Friday.

Now, where do we go from here? Is it time to sell it all and go short?

Not quite.

Bulls are clearly driving this market, and there is nothing bearish about all time highs.

/NQ Weekly Chart |  /ES Weekly Chart |

However, there are a few patterns that would suggest caution.

The 10 day simple moving average of the Put/Call Ratio is back below 0.8, which means calls outweigh puts. When the market gets too long, it can have a tendency to crush your dreams. The trend is clearly still bullish, but if most market participants are long, it can be trouble if the tone shifts. This is not a perfect science, but it is a pattern that has proven valuable.

There is a bit of seasonality to be aware of. We have started a new month, and if you look back at February over the past several years, it has been pretty weak (with the exception of ‘21). So, just another pattern that we should be aware of when making long decisions.

I like to focus on trading with the trend, with very few of my trades being counter-trend at key levels. So, I am not getting short just yet, but I am ready for a signal. I am focusing on good setups to the long side, but will be limiting my exposure to the overall market with fewer positions.

Alright, let’s get back to the main show. Here is what I’m trading this week.

1.) GS Long

Daily Chart Setup

Reasoning:

Bullish Trend (8 ema > 21 ema > 34 ema); trading with the trend

Daily Squeeze with shifting momentum, which means a higher probability of making a larger move.

My Levels:

Entry Zone: $376 - $384

8 ema (blue line in chart) to the 34 ema (green line in chart)

The current price is above the entry zone, so will wait for a pullback. Pricing entries at $382.

Targets: $400 - $416

T1: $400

T2: $416

All of these are based on fibonacci clusters from prior swings

There is a target overhead at new highs ($428), but will be focused on more conservative targets.

GS Options Strategies

**reminder: exits are theoretically priced two weeks out, but the price of the underlying is the primary trigger for taking the trade off.

Long Calls (Delta 65, 74 Days to Expiration, $370 Strike)

Entry: BUY +1 GS 100 19 APR 24 370 CALL @23.50 LMT

Exit T1: SELL -1 GS 100 19 APR 24 370 CALL @35.00 LMT

Exit T2: SELL -1 GS 100 19 APR 24 370 CALL @48.50 LMT

Long Call Debit Spread (Buying $390 & Selling $420 strikes, 41 Days to Expiration)

Entry: BUY +1 VERTICAL GS 100 19 APR 24 390/420 CALL @9.250 LMT

Exit T1: SELL -1 VERTICAL GS 100 19 APR 24 390/420 CALL @13.50 LMT

Exit T2: SELL -1 VERTICAL GS 100 19 APR 24 390/420 CALL @18.50 LMT

2.) FERG Long

Daily Chart Setup

Reasoning:

Bullish Trend (8 ema > 21 ema > 34 ema); trading with the trend

Daily Squeeze, which means a higher probability of making a larger move.

My Levels:

Entry Zone: $186 - $190

8 ema (blue line in chart) down to the 34 ema (green line in chart)

The current price is above the entry zone, but I’m fine getting more aggressive with this one, given we are near all time highs, and the trend is solid. Pricing entries at $190.

Targets: $197 - $208

T1: $197

T2: $200

T3: $208

All of these are based on fibonacci clusters from prior swings

FERG Options Strategies

**reminder: exits are theoretically priced two weeks out, but the price of the underlying is the primary trigger for taking the trade off.

Long Calls (Delta 69, 41 Days to Expiration, $185 Strike)

Entry: BUY +1 FERG 100 15 MAR 24 185 CALL @10.00 LMT

Exit T1: SELL -1 FERG 100 15 MAR 24 185 CALL @14.00 LMT

Exit T2: SELL -1 FERG 100 15 MAR 24 185 CALL @16.50 LMT

Exit T3: SELL -1 FERG 100 15 MAR 24 185 CALL @23.50 LMT

Long Call Debit Spread (Buying $190 & Selling $200 strikes, 41 Days to Expiration)

Entry: BUY +1 VERTICAL FERG 100 15 MAR 24 190/200 CALL @3.75 LMT

Exit T1: SELL -1 VERTICAL FERG 100 15 MAR 24 190/200 CALL @5.50 LMT

Exit T2: SELL -1 VERTICAL FERG 100 15 MAR 24 190/200 CALL @6.30 LMT

Exit T2: SELL -1 VERTICAL FERG 100 15 MAR 24 190/200 CALL @8.00 LMT

3.) CARR Long

Daily Chart Setup

Reasoning:

Bullish Trend (8 ema > 21 ema > 34 ema); trading with the trend

Daily Squeeze with positive momentum, which means a higher probability of making a larger move.

5% off of All Time Highs, which means there is likely less resistance overhead

My Levels:

Entry Zone: $55 - $56.5

slightly above the 8 ema (blue line in chart) down to the 34 ema (green line in chart)

The current price is slightly abve the entry zone, but I am looking to enter more aggressively for this one. Pricing entries at $56.50, as I’ll enter if we get a slight dip at the open Monday.

Targets: $64 - $69

T1: $64

T2: $69

All of these are based on fibonacci clusters from prior swings

CARR Options Strategies

**reminder: exits are theoretically priced two weeks out, but the price of the underlying is the primary trigger for taking the trade off.

Long Calls (Delta 83, 41 Days to Expiration, $50 Strike)

Entry: BUY +1 CARR 100 15 MAR 24 50 CALL @6.50 LMT

Exit T1: SELL -1 CARR 100 15 MAR 24 50 CALL @13.75 LMT

Exit T2: SELL -1 CARR 100 15 MAR 24 50 CALL @19.00 LMT

Long OTM Calls (32 Delta, 41 Days to Expiration)

Rare I buy long calls OTM. This is a cheaper lower risk play - basically, risking the debit paid. If this doesn’t go my way the next two weeks, theta decay will take this to 0 pretty quickly. It is not worth doing a call debit spread because OTM strikes have very little premium to offset the debit paid.

Entry: BUY +1 CARR 100 15 MAR 24 60 CALL @1.00 LMT

Exit T1: SELL -1 CARR 100 15 MAR 24 60 CALL @4.70 LMT

Exit T2: SELL -1 CARR 100 15 MAR 24 60 CALL @9.20 LMT

4.) Others I’ll Be Watching Long

LEN

LEN Daily Chart Setup

FOUR

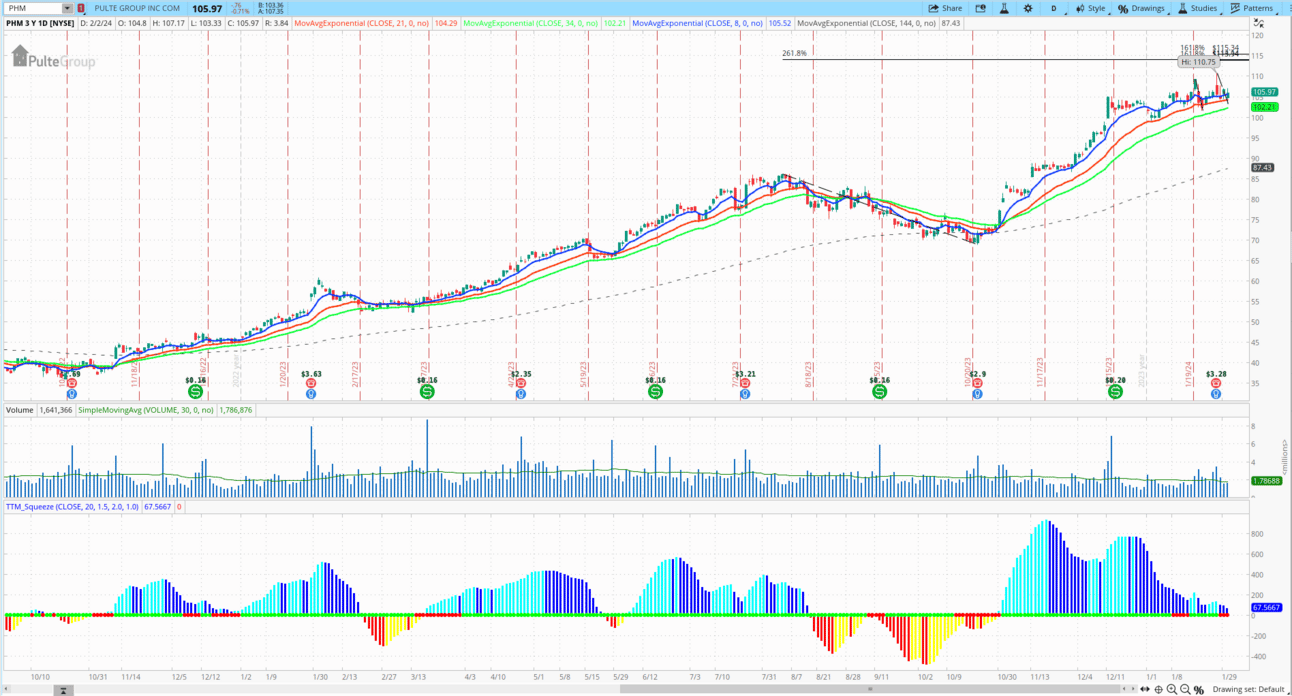

PHM

Reasoning:

Bullish Trend (8 ema > 21 ema > 34 ema); trading with the trend

Daily Squeeze, which means a higher probability of making a larger move.

As always, if I trade any setups that fit into my trading plan, I’ll share via email. I’ll keep you posted!

Open Trades Review

Week of 1/14 Trade Ideas

OC (1/16 entry)

Took 2/3rds off at $158, given earnings are coming up. Holding 1/3rd to see if we get a run up prior to the announcement. Will look to take off before.

H (1/16 entry)

Still holding. It is taking it’s time, but the setup still looks good. Nothing has changed.

MA (CLOSED)

Got a pop after the earnings call in the AM, all targets hit. Flat MA - great trade. I normally don’t like to hold through earnings - I was thinking the call was after hours. Only had half position still left.

KKR (1/16 entry)

First target was hit this week: $87. Took off 1/3rd. Still holding the remaining 2/3rds to see if we can get some follow through. Chart pattern still looks good. Nothing has changed.

Week of 1/21 Trade Ideas

ULTA (CLOSED)

We got strength into $506 Monday and took profits - great trade.

EXPD (CLOSED)

This might still be ok, but it broke the rules and there are better opportunities out there. I closed the remaining portion (2/3rds position) for a loss, as it looked like we were going to get the second close below the 34 EMA. Flat EXPD

ROST (CLOSED)

We got strength into $142 Monday and took profits on the remaining 2/3rds. These expired soon, so didn’t have time to wait for $150. I’ll take it - great trade!

BLK (1/16 entry)

Still holding. Chart pattern still looks fine - holding the 34 EMA for support. These expire soon, so will look to take everything off if we get a bit of strength.

MPC (CLOSED)

Broke my typical rules and held through earnings - reasoning was the weekly bullish squeeze, supporting a longer bullish move. First two targets hit - took everything off at $169.5. Great trade!

Week of 1/28 Trade Ideas

UHS (2/1 entry)

Good entry with a bit of strength that quickly followed. Took off 1/3rd just shy of $165, but holding another 2/3rds for $170-180. Daily squeeze fired long, so looking for follow through.

PVH (1/31 entry)

This hit T1 ($125) before I was able to enter, so I’ll be looking for $128 and $147 overhead. Got a solid entry, and the chart still looks good - the bullish structure still holds, putting probability in our favor

CSX (1/29 entry)

Didn’t quite reach T1: $37, but probably could have taken some chips off the table, as we got about 0.50 shy. Still holding half for some follow through this week - daily squeeze in tact, which should push it higher.

That’s it, that’s all. Let me know what you thought of this week’s Sunday Setups!